Selling a Manufacturing Business? Don’t Ignore This Guide

You’ve built your business with tangible outcomes in mind. Manufacturing is as hands-on as it gets!

Now that you are thinking of selling, it can be difficult to quantify all the intangible assets that make up the heart and soul of your company–after all, your business is so much more than the product you produce.

You need a team of professionals, including lawyers, financial experts, and more, to help ensure you don’t sell yourself or your business short.

This blog takes you through the process of selling a manufacturing business and how Exitwise can help you expedite everything.

TL;DR - How to Sell a Manufacturing Business

Selling your manufacturing business doesn’t have to be overwhelming. Consider the following steps:

Business Valuation

Prepare Financial Records

Enhance Business Appeal

Confidentiality Agreement

Market the Business

Screen Potential Buyers

Negotiate Terms

Due Diligence

Finalize Sale Documents

Transition Plan

Exitwise makes the process of selling your manufacturing business simple! Let’s examine each step in detail in this blog.

How Do You Determine the Value of a Manufacturing Business?

You can use a few different ways to determine the value of your manufacturing business, including:

Earnings-based valuations

Market comparables

Income-based valuations

Cost-based valuations

The most common way to determine your manufacturing company’s value is to use earnings-based valuations.

With this method, value is determined by looking at earnings over a certain time period and assuming similar future earnings growth.

What is the Average Multiple for a Manufacturing Company?

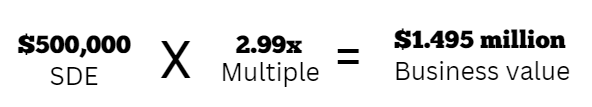

A valuation multiple is a ratio that compares two factors, such as the business’ earnings compared to the implied value of the company, known as the SDE (Seller’s Discretionary Earnings) multiple. The average SDE multiple is between 2.68x and 3.54x.

Here’s an example of how it works:

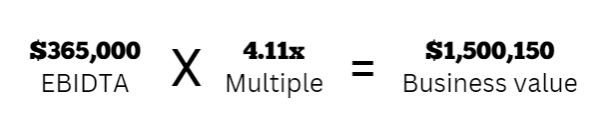

Another valuation multiple compared to net income is the EBITDA multiple, which looks at Earnings Before Income, Taxes, Depreciation and Amortization. The average EBITDA multiple for a manufacturing business is between 3.54x and 4.19x.

Here’s an example of how it works:

Remember, these are simply average examples. Your unique business size, sector, and product all factor into your average multiple.

What Documents Are Needed to Sell a Manufacturing Business?

Many documents are needed in the sale of your manufacturing business. It is best practice to hire a team of professionals to ensure you are preparing everything correctly.

Some common documents you need to sell your manufacturing business include:

Articles of incorporation (everything you prepared and signed when you first became a business).

Business licenses, real estate documents, employment contracts (everything that keeps you in business day-to-day).

Tax records and returns, bank and financial statements, and credit history documents (everything that demonstrates how you pay to do business).

Accounting of inventory, suppliers, and distributors (everything you sell, who you buy it from, and who you sell it to).

We can help you find and manage the best team of professionals to collect, prepare, and account for these documents.

10 Parts of Selling a Manufacturing Business

Now that we’ve covered some of the initial basics of selling your manufacturing company, let’s plan a path forward with the following steps:

1. Business Valuation

The most important step, as we’ve gone over already, is correctly valuing your business to fully realize your success and get what you have worked years putting into it.

To get started, explore Exitwise’s free valuation calculator. While this gives you a good indication of the value range of your manufacturing business, you’ll need a team to help you narrow that value down.

We can help you find, hire, and manage the right professionals to move forward with your sale.

2. Prepare Financial Records

As noted, you’ll need to collect, collate, and prepare a bevy of financial records to sell your manufacturing company.

From tax returns to employment contracts, from the forms that made you a business to the licenses that keep you in business, you’ll need help ensuring that all financial records are prepped, ready, and included.

Exitwise can help you get the best prices for your manufacturing company by hiring and managing the right M&A experts for you.

3. Enhance Business Appeal

You wouldn’t try to sell your house for top dollar without making sure it had the most curb appeal possible, right? It’s the same with selling your manufacturing company!

Enhance your manufacturing business’ curb appeal by carrying out the following:

Sell while your sales are up and growing, even if incrementally.

Fix any issues with your manufacturing warehouses and ensure any space you own is clean and running smoothly.

Shine a spotlight on the ways in which you fill a niche in your market and update your marketing materials accordingly.

Continue to build a solid foundation with others in your industry. Sound relationships sell companies.

Due diligence will be discussed in detail in step eight, but one of the best ways to enhance your manufacturing company’s appeal is to complete a thorough and transparent due diligence process.

4. Confidentiality Agreement

Preparing a confidentiality agreement prior to the sale of your manufacturing company is an important step in securing your trade secrets and the sale itself.

It is important for confidentiality agreements to include terms that clearly detail the return of all information to you once the potential buyers have reviewed it.

Additionally, any interested parties must be legally bound to refrain from discussing your business and the forthcoming sale until the sales contract has been finalized.

This integral step in your merger and acquisition process cannot be completed without the aid of legal counsel.

5. Market the Business

Not only do you have to enhance your manufacturing company’s appeal, you also need to market that appeal to potential buyers.

While you may have a solid marketing plan in place for your product, this step is about marketing your entire business (both the tangible and intangible parts).

6. Screen Potential Buyers

Once you’ve marketed your manufacturing business successfully and buyers have come forward with interest, you’ll need to screen them to determine if they are the right fit to acquire your business.

A few questions can help you decide which potential buyer is the right one:

Do they have the knowledge, licenses, background, etc. needed to take over your manufacturing business?

Are they interested in your business specifically?

Can they afford your asking price?

Will they be able to purchase your manufacturing business when you want to sell it?

How motivated are they to move forward with the purchase?

Finding the best buyer for your manufacturing business takes forethought, skill, and time. Don’t rush this step!

7. Negotiate Terms

As you may imagine, the terms of selling your manufacturing business can be quite complex. You’ll want to consider tax implications, earning protections and warranties, indemnification, and more.

Arriving at negotiations fully prepared and with a team of experts to back you up is the best way to find success.

8. Due Diligence

The due diligence process is one in which you, the seller of a manufacturing business, provide potential buyers with all the data, documents, and decision-making material they need to feel comfortable making the purchase.

Once again, preparation is the name of the game for this step of selling your manufacturing company. Ensuring a smooth purchase process starts with preparing the best due diligence package possible.

9. Finalize Sale Documents

The ninth step in selling your manufacturing business is one that you cannot do without the hired help of a specialized legal team.

Finalizing your sale documents includes technical skills that only seasoned mergers and acquisitions law firms possess. Don’t try to go it alone–you need the help of a team of professionals!

10. Transition Plan

Before you take payment for the sale of your manufacturing business (generally referred to as “closing”), but after everything else is complete, you’ll need to prepare and follow a detailed transition plan in collaboration with the buyer.

Your manufacturing company has many moving parts. Remember all those tangible and intangible pieces we’ve been talking about?

While the actual sale can be finalized with signatures on all the right documents, the transition from you as owner of the manufacturing business to the right new owners will take careful planning.

How Long Does This Process Take?

On average, selling your manufacturing business should take between six and twelve months. Considering all the steps above and the time and effort needed for each one, that’s not a long time at all.

Remember, Exitwise stays with you throughout the process.

We’ve helped so many companies through this entire process, including the successful sale of the manufacturing company Great Lakes Tile Products!

What Are The Common Challenges of This Process?

Ten of the most common challenges to selling your manufacturing business include:

Determining the correct value of your manufacturing company.

Deciding on the right time to sell.

Finding the right buyer at the right time.

Jumping through the myriad legal and technical hoops.

Dealing with stress associated with the selling process.

Drafting and maintaining the right documents, especially confidentiality agreements.

Understanding the technical tax structures that have major implications on the sale of your manufacturing business.

Coming to terms with walking away from the business you’ve built.

Managing current employees, their stress and insecurity.

Finding the right team of professional experts to help you navigate every challenge.

Exitwise can take care of number ten–which helps you tackle all the other challenges listed and any others you might face in the process of selling your manufacturing business.

Conclusion

Of all the things your hands have held and worked to build, the things you can’t hold sometimes add up to more than you ever thought possible.

Your manufacturing company is worth more than what you can see and touch. It would be an impossible task for you alone to determine the value of this business you’ve built from the ground up.

Selling your manufacturing business is not a process you should take on by yourself.

Exitwise is ready to prepare the way for you to get the most out of everything that makes up the real value of your manufacturing business.